Ask anyone you know what the most important things in their life are. The top five things that they think about the most often?

You will hear answers like:

* Family

* Health

* Job

* Home

* Vehicles

These are probably the very same things that are most important to you, too.

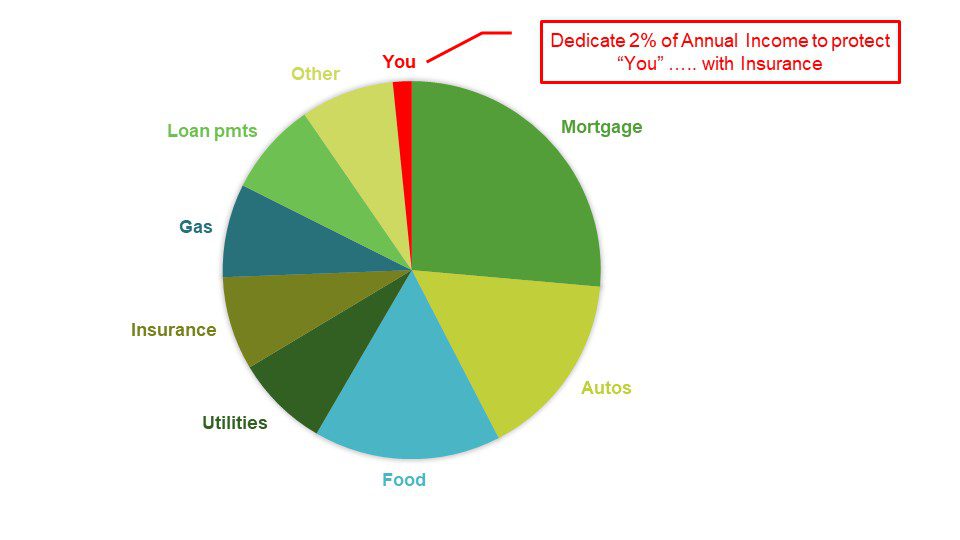

Leveraging what people say is the most important to them, we use a very simple and effective life illustration to have a Life needs conversation. It’s called the 2% Rule.

When you ask them the question, of the five things they list, chances are you’re going to be able to help them with three of them through Life insurance.

You’ll present this from a budget planning perspective. You’ll then pose this question to the prospect:

“If you could protect the most important things in your life with just 2% of your gross income, does that seem reasonable?”

The next step is to chart where their money (income) is currently being allocated. We like to use a pie chart.

When someone sees a visual representation of where they currently allocate funds, and you pencil in a small 2% sliver of pie into the chart, it makes the idea of investing just 2% in Life insurance very reasonable and even logical. It is a small percentage to ensure that their biggest investments, assets, and people they care for most and are responsible for are protected.

And then the individual can determine what they want and should do with the other 98%. Their full pie will cover protection for the short-term and the long-term.

The 2% Rule life illustration is simple, effective, logical, and easy for people to understand.

Use it during annual reviews with existing customers and during onboarding with new customers.

How many of those conversations are you going to have?